Today we’d like to introduce you to Ryan Lee Chapman.

Hi Ryan Lee, so excited to have you on the platform. So before we get into questions about your work-life, maybe you can bring our readers up to speed on your story and how you got to where you are today?

I started my career in mortgages with a simple belief that people deserve a fair shot at homeownership and clear guidance through a process that is often confusing. Early on, I saw too many qualified buyers turned away because of rigid systems, poor communication, or a lack of effort to find real solutions. I knew there had to be a better way.

I built my business by focusing on problem solving, education, and relationships. Instead of just originating loans, I took the time to truly understand lending guidelines and how to navigate them. I made it a priority to take full responsibility for every file and to communicate clearly with both clients and partners. That approach led to strong Realtor relationships, consistent growth, and a reputation for reliability and speed.

Over time, that mindset became Hope Mortgage Solutions. The focus has always been on transparency, persistence, and creating a positive experience for the people I serve. Today, I specialize in helping first time buyers, self employed borrowers, and clients using down payment assistance or grant programs. I also spend a lot of time educating the community so people feel confident long before they apply for a loan.

The path has not always been easy, but every challenge reinforced why I started. When you combine knowledge, persistence, and genuine care for people, you can create real opportunities and lasting impact.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

Not at all. It has been anything but a smooth road.

Like most entrepreneurs, I faced uncertainty early on, especially while building consistency and trust in a competitive industry. There were deals that fell apart at the last minute, clients who had been told no elsewhere and came with complex challenges, and long stretches of working nights and weekends to make things work. Learning the business deeply took time, and there were moments where the responsibility and pressure felt heavy.

Another challenge was choosing to do things the right way instead of the easy way. Clear communication, full transparency, and taking ownership of every file require more effort, especially when expectations are high. There were also growing pains as the business expanded, including refining systems, managing time better, and learning when to delegate.

Each struggle forced me to improve, adapt, and stay resilient. Those experiences shaped how I work today and reinforced my commitment to serving clients with care, honesty, and persistence.

Thanks for sharing that. So, maybe next you can tell us a bit more about your business?

ope Mortgage Solutions exists for people who want clarity, speed, and a real advocate in the home-buying process.

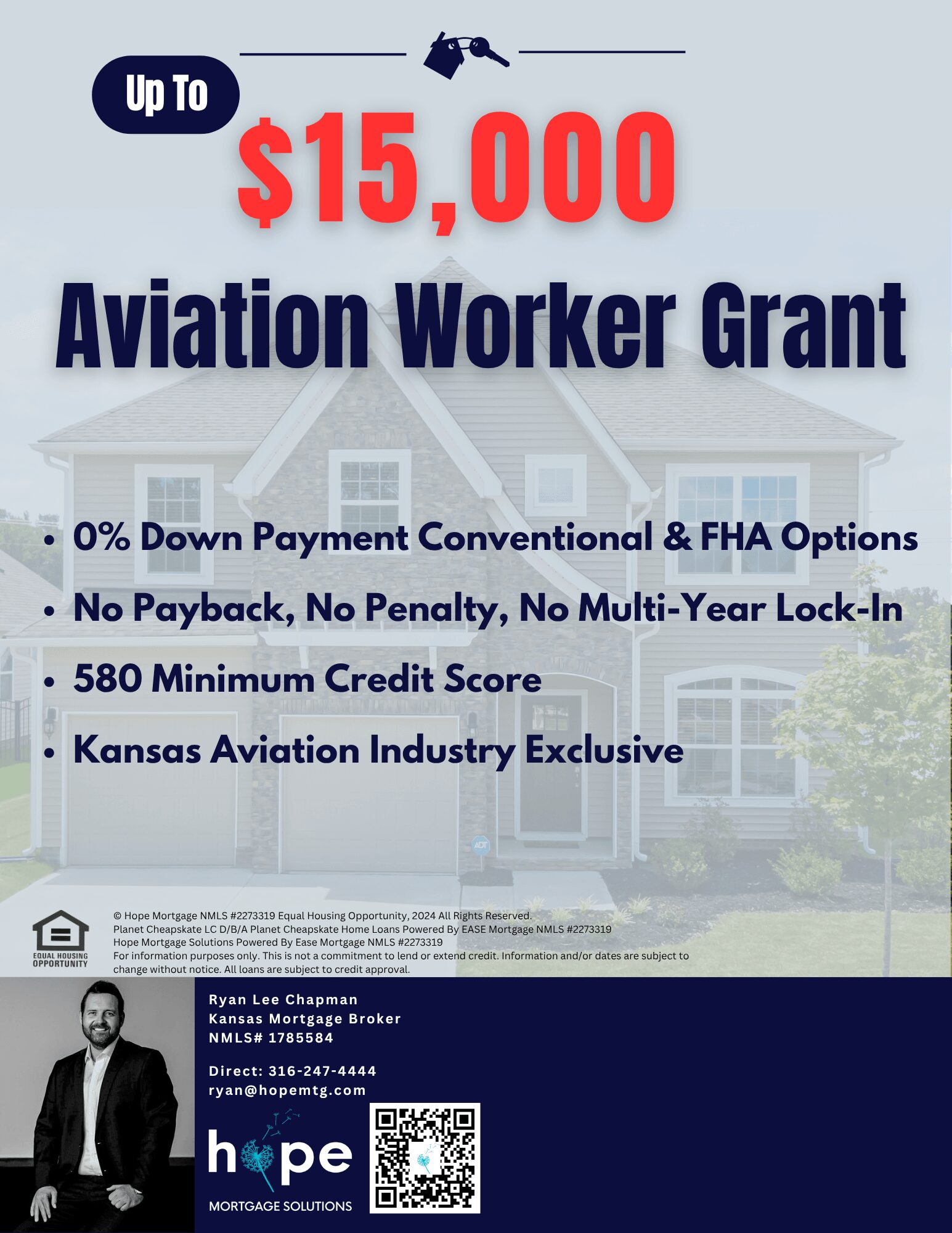

We are a Kansas-based mortgage brokerage that helps buyers secure financing with confidence, whether they are purchasing their first home, self-employed, relocating, or using down payment assistance or grant programs. Our role goes far beyond quoting rates. We guide clients through strategy, structure, and timing so they understand their options and can make informed decisions.

What we are known for is problem solving and follow through. We take full ownership of every file, communicate clearly with all parties involved, and move with urgency. We are especially strong in situations where other lenders struggle, including complex income, credit challenges, and layered assistance programs. Speed matters, and our systems are built to close efficiently without cutting corners.

What sets us apart is our mindset. We do not treat loans as transactions. We treat them as responsibilities. We invest heavily in education, both for our clients and for our partners, so there are fewer surprises and better outcomes. We also work closely with Realtors to ensure offers are competitive and expectations are aligned from the start.

Brand wise, I am most proud of the trust we have built. Hope Mortgage Solutions stands for persistence, transparency, and doing what is right even when it takes more effort. Our name is intentional. Many of the people we help come to us after being told no, and our job is to bring solutions, clarity, and hope back into the process.

What I want readers to know is simple. We are here to help people win. Whether that means finding the right loan structure, navigating assistance programs, or simply having someone in their corner who will not give up, that is the standard we hold ourselves to every day.

What matters most to you?

What matters most to me is people and the responsibility that comes with serving them.

Buying a home is one of the biggest financial decisions most people will ever make. It impacts their family, their stability, and their future. I take that responsibility seriously. Doing the job well is not just about getting a loan approved. It is about being honest, prepared, and fully committed to helping someone make the best decision for their situation.

I also care deeply about trust. Trust is earned through clear communication, follow through, and doing the right thing even when it is harder. That is why I focus on education and transparency. When people understand the process, they feel confident instead of anxious, and that changes the entire experience.

At the end of the day, what drives me is impact. Helping someone move from uncertainty to ownership, from being told no to hearing yes, is meaningful work. Knowing that I played a role in creating stability and opportunity for a family is why I do what I do.

Contact Info:

- Website: https://hope-mortgage.com

- Instagram: https://www.instagram.com/hopemortgage/

- Facebook: https://www.facebook.com/hopemortgage/

- Youtube: https://www.youtube.com/channel/UCZXYpb1Q87Vk7A-ZiaGs7tg