Today we’d like to introduce you to Pat Brown.

Hi Pat, can you start by introducing yourself? We’d love to learn more about how you got to where you are today?

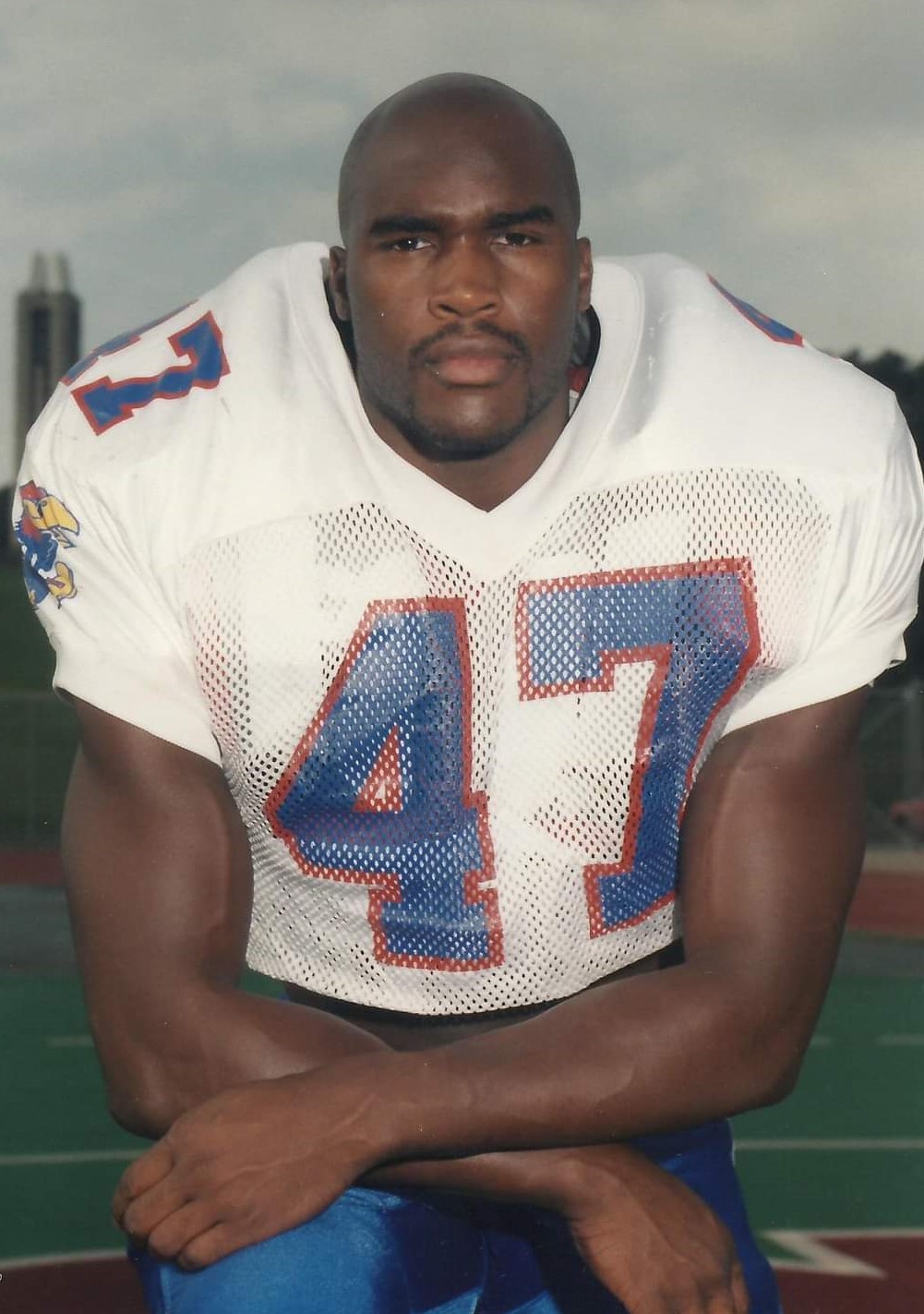

My journey into financial literacy for student-athletes really began with my own experience. I played Division I football at the University of Kansas in the 1990s, serving as a team captain my senior year. Like many student-athletes, I poured everything into the game and my education, but I didn’t have a strong understanding of money. When my playing days ended, I realized just how unprepared I was financially for life after sports.

That personal struggle planted a seed. As I moved into the financial services industry, I became passionate about making sure the next generation of athletes wouldn’t face the same challenges. When Name, Image, and Likeness (NIL) legislation passed, allowing college athletes to profit from their personal brand, I immediately saw the need. Overnight, student-athletes were signing contracts, getting sponsorships, and earning money—often with little guidance on taxes, budgeting, or long-term planning.

I launched www.FinancialLiteracyForNIL.com

and www.FinancialLiteracyForStudentAthletes.com

as educational platforms to fill that gap. These sites provide athletes, parents, and coaches with tools, resources, and straightforward guidance on topics like budgeting, credit, investing, taxes, and the business side of NIL.

Along the way, I’ve also written five books specifically focused on NIL and financial literacy:

Financial Literacy for NIL

Financial Literacy for NIL – Parents of Student Athletes

Financial Literacy for NIL – International Student Athletes

Financial Literacy for NIL – High School Student Athletes

Tax Literacy for NIL

These books are designed to meet athletes and their families wherever they are on their journey, whether that’s high school, college, or navigating international rules. Beyond NIL, I’ve also expanded my writing to other audiences—doctors, attorneys, engineers, divorcees, and more—because financial literacy is universal.

Where I am today is a continuation of that mission: empowering athletes to see themselves not just as players, but as CEOs of their own future. If they can learn to manage money wisely during their college years, those lessons will serve them for a lifetime, no matter what path they take after sports.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

Not at all. Like any new movement, building out a platform for financial literacy in the NIL era has come with plenty of challenges.

One of the biggest struggles early on was awareness. When NIL first became reality, there was a wave of excitement and opportunity, but very little structure. Athletes, parents, and even universities weren’t sure where to turn for guidance. I was building resources—websites, books, and educational materials—before many people even realized how urgent the need was. That meant a lot of work went into creating frameworks, curriculums, and platforms without the guarantee that the audience was ready yet.

Another challenge has been credibility. As a former Division I athlete, I understood the student-athlete experience, but I also had to prove that I wasn’t just telling stories from my playing days—I had the professional financial expertise to back it up. Writing five NIL-focused books, creating multiple dedicated websites, and continually engaging with athletes, parents, and coaches helped establish that credibility, but it took time and persistence.

There’s also the constant challenge of keeping up with change. NIL rules are evolving, and what’s true today may look very different in a year. I’ve had to stay flexible, always learning, adapting, and updating my resources so that athletes have the most accurate and relevant guidance.

At times, it’s felt like pushing a boulder uphill—educating schools, parents, and athletes while building something that didn’t exist before. But the struggles have been worth it. Every time an athlete tells me they avoided a costly mistake, learned how to budget, or began saving for their future, it reminds me why the difficult road was necessary.

Great, so let’s talk business. Can you tell our readers more about what you do and what you think sets you apart from others?

By trade, I am a Private Wealth Manager with Creative Planning, where I work with clients every day on comprehensive financial planning, investments, insurance, retirement, and generational wealth strategies. That’s my career and what I’m deeply committed to on a professional level.

At the same time, I have what I call my passion project: Financial Literacy for NIL. This work grew out of my own background as a former Division I football player at the University of Kansas, and it’s become a mission to give today’s athletes the financial education that many of us never received.

Through my platforms—www.FinancialLiteracyForNIL.com

and **www.FinancialLiteracyForStudentAthletes.com**—I’ve

created resources that help athletes, parents, and coaches understand money in practical ways. We cover the basics—budgeting, credit, debt, and investing—but also the unique complexities of NIL: contracts, taxes, business structures, branding, and compliance.

I’ve also written five NIL-focused books (Financial Literacy for NIL, Financial Literacy for NIL – Parents of Student Athletes, Financial Literacy for NIL – International Student Athletes, Financial Literacy for NIL – High School Student Athletes, and Tax Literacy for NIL) along with additional financial literacy books for professionals like doctors, attorneys, and engineers.

What sets me apart is that I live in both worlds. On one side, I have the resources, credibility, and experience of being a wealth manager with one of the largest independent firms in the country. On the other, I have the heart of a former athlete who knows exactly what it feels like to face major life transitions without the tools or financial education to handle them.

Brand-wise, I’m most proud that Financial Literacy for NIL isn’t about selling a product—it’s about creating a movement. I want athletes to see themselves as CEOs of their own future and understand how to make smart decisions whether they go pro or not.

What I’d like readers to know is simple: financial literacy changes lives. For a retiree choosing Medicare coverage, for a family planning their future, or for a student-athlete signing their first NIL deal, the knowledge to make informed decisions is priceless. That’s the mission that drives me, whether I’m serving clients at Creative Planning or writing another book to empower the next generation.

Do you have any advice for those just starting out?

My biggest piece of advice is to start with the basics and don’t underestimate their importance. When I was a student-athlete, I thought financial success meant chasing big numbers, but the truth is, it starts with simple habits—budgeting, tracking what comes in and goes out, avoiding unnecessary debt, and understanding taxes. Those fundamentals don’t sound flashy, but they’re what build long-term stability.

For athletes just starting out in the NIL space, I’d also say: treat yourself like a business from day one. Whether it’s a $500 deal or a $50,000 deal, you’re entering into contracts, tax responsibilities, and brand decisions that can have real consequences. Think of yourself as the CEO of “You, Inc.” and make decisions accordingly.

Something I wish I had known when I was younger is that saying yes to everything isn’t always the best path. Opportunities are exciting, but the real power comes from learning when to say no, when to slow down, and when to get advice before making a big decision.

Finally, surround yourself with people who actually want the best for you. Coaches, mentors, and professionals can help, but you need to be intentional about who’s in your circle. A good accountant, attorney, or advisor can save you from mistakes that might take years to recover from.

If I could boil it all down: start small, stay disciplined, and think long-term. That’s true for NIL deals, careers, and life in general.

Contact Info:

- Website: https://www.financialliteracyfornil.com

- Instagram: financial_literacy_student_ath

- Twitter: @finlit4nil