Today we’d like to introduce you to Mallory Baska.

Hi Mallory, we’d love for you to start by introducing yourself.

I’ll never forget the feeling at age 22 when all this “money stuff” started to hit me like a freight train. Luckily, it wasn’t in a dire straight type of situation, but I still remember the day. I opened up my employer-sponsored 401(K) for the first time and thought – I must have missed this class in school! Half of the website felt like a foreign language and I felt myself going cross-eyed after 30 seconds of attempted navigation. Next up, I attended the HR sponsored health benefits session and thought… what the heck do they mean by investing in your HSA? The swirl and confusion only continued when it came to reviewing my husband’s student loans, buying a house, taxes.. The list could go on and on!

I didn’t enjoy feeling so vulnerable when it came to personal finances, my money, and ultimately my livelihood and time on this Earth! And my “financial advisor” wasn’t helping me LEARN. So, I dove in. I spent (and still do today!) hours devouring personal finance-related books, blogs, podcasts, and even attending paid, weekend-long educational seminars.

I’ve gone from living paycheck to paycheck and filled with financial anxiety to becoming a self-made millionaire in 10 years. I paid off $60K in debt along the way, became a real estate investor, and have since worked in strategic investing for my children. The lifelong impact of getting your finances in order is invaluable – and truly more straightforward than you might think.

My mission is to help Millennial + Gen Z women improve their financial literacy via easy-to-digest education and relatable living. No #mansplaining here.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

Definitely not! Has any entrepreneur had a “smooth road”?!

My business started as a passion project on Instagram. Like many young professionals without kids during COVID – I got a little stir crazy with the extra time on my hands while WFH for 1.5 years. I quickly started growing an audience and opportunities started presenting themselves from 1:1 coaching to brand sponsorships and speaking engagements.

It was a tough juggle alongside a FT job in Marketing for 3 years! In that time frame I also had my first son and by then I knew I would meet a fork in the road so I was motivated to get my business in a place to take FT. After maternity leave with my first son, I returned to work for a short while (long enough to get my bonus and equity payout) and then resigned.

I’ve been FT with my business for exactly 1 year and since had my second son! Juggling a maternity leave (newborn + toddler) as a sol0 entrepreneur hasn’t been easy but boy has it been worth it.

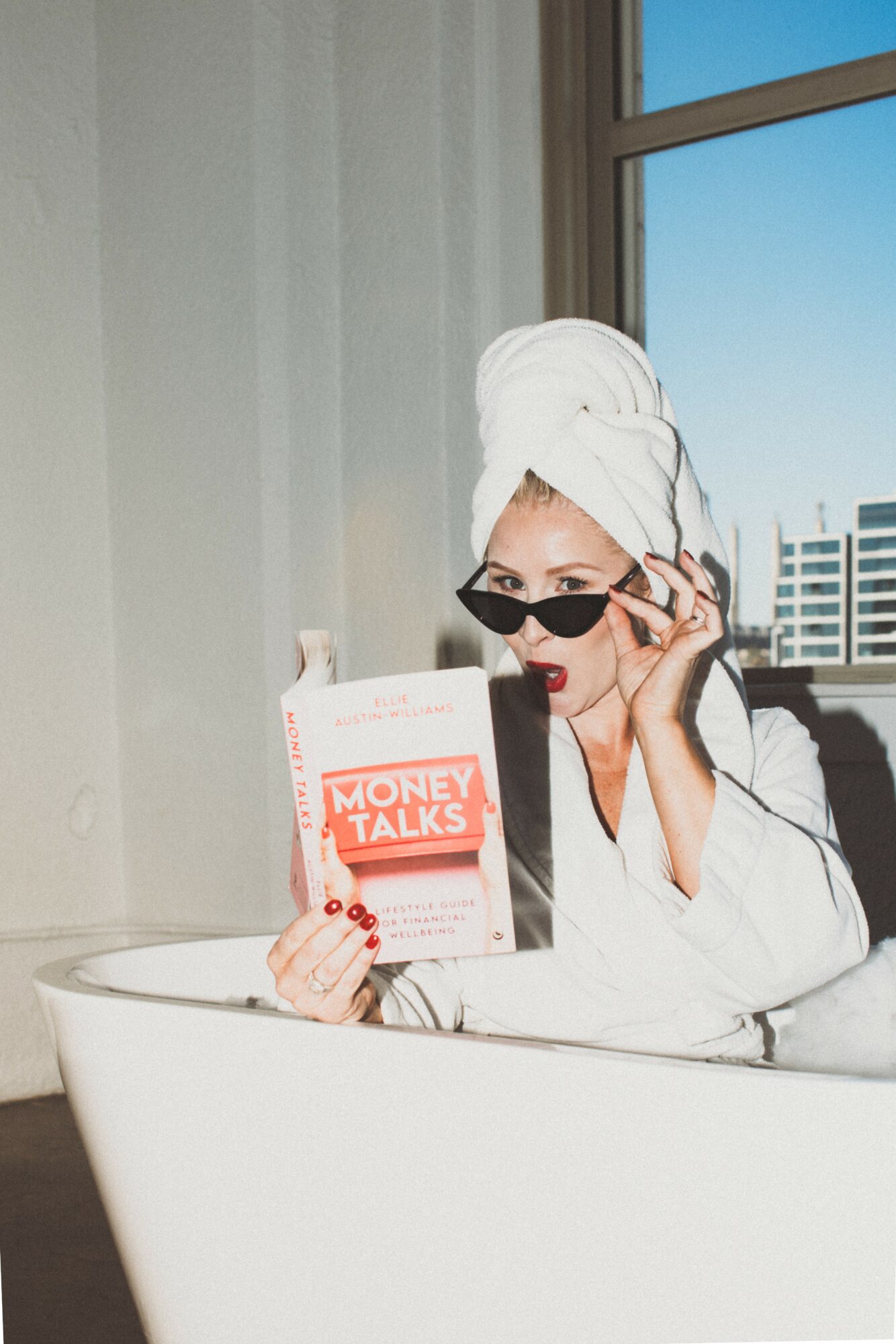

We’ve been impressed with Money Talk Mal, but for folks who might not be as familiar, what can you share with them about what you do and what sets you apart from others?

Money Talk Mal is a purpose driven financial literacy company on a mission to help Millennial + Gen Z women improve their financial literacy via easy-to-digest education, 1:1 coaching, and relatable living. We showcase relatable living, normalize money talk, and serve up practical + digestible strategies to help you break generational cycles & turn material girl dreams into millionaire realities. When women are involved and contributing to long-term financial planning, everyone wins.

Can you talk to us about how you think about risk?

While I fall in the more conservative camp – my money-conscious mind sometimes limits me from taking big business risks – I believe risk is required to achieve big goals. It was risky to leave my lucrative, stable corporate job where I had established great rapport with leaders. However, I knew I would die with regret if I didn’t place a bet on myself. 1 year in and ZERO regrets!

Pricing:

- Varies

Contact Info:

- Website: https://www.fuelingfinancialfreedom.com

- Instagram: @moneytalkmal